Depreciation formula math calculator

Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. It can be calculated using its depreciation.

Exponential Functions Ti Nspire Car Depreciation Project

Depreciation - Math Formulas - Mathematics Formulas - Basic Math Formulas Javascript is disabled in your.

. It is determined by multiplying the book value of the asset by the straight-line methods rate of depreciation and 2 read more method to calculate the tanks depreciation expense. 4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Math Pictures Credit Education. It provides a couple different methods of depreciation.

How to Calculate Straight Line Depreciation. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Determine the cost of the asset.

Subtract the estimated salvage value of the asset from. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. The calculator also estimates the first year and the total vehicle depreciation.

Select the currency from the drop-down list optional Enter the. 2 Methods of Depreciation and How to Calculate Depreciation. It is fairly simple to use.

Using the formula for simple decay and the observed pattern in the calculation above we obtain the following formula for compound decay. For example if you have an asset. Salvage value is the estimated resale value of an asset at the end of its useful life.

The depreciation amount will be as follows. Also find Mathematics coaching class for various competitive exams and classes. In this lesson we will cover.

The calculator allows you to use. Percentage Declining Balance Depreciation Calculator. The Formula used by Depreciation Calculator.

A book value or depreciated. Formula for the double declining balance method is 2 X Cost of the asset Depreciation rate. Balance Formula with Double Declining 2 X Cost of.

21 Fixed Installment or Equal Installment or Original Cost or Straight line Method. What appreciation and depreciation are how to calculate and solve problems involving appreciation or depreciation Appreciation is the. A P1 in.

Asset Cost Salvage Value Useful Life Depreciation Per Year. Calculate depreciation of an. Lets take a piece of.

The straight line calculation steps are. All you need to do is. First one can choose the straight line method of.

The basic formula for calculating your annual depreciation costs using the straight-line method is. Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of SalvageCost 1Life Variable Declining Balance Depreciation. Non-ACRS Rules Introduces Basic Concepts of Depreciation.

22 Diminishing balance or Written down. Double Declining Balance Method. This depreciation calculator is for calculating the depreciation schedule of an asset.

The simplest and most commonly used straight line depreciation is calculated by taking the purchase or acquisition price of an asset subtracted by the salvage value divided by the total.

Wacc Diagram Explaining What It Is Cost Of Capital Financial Management Charts And Graphs

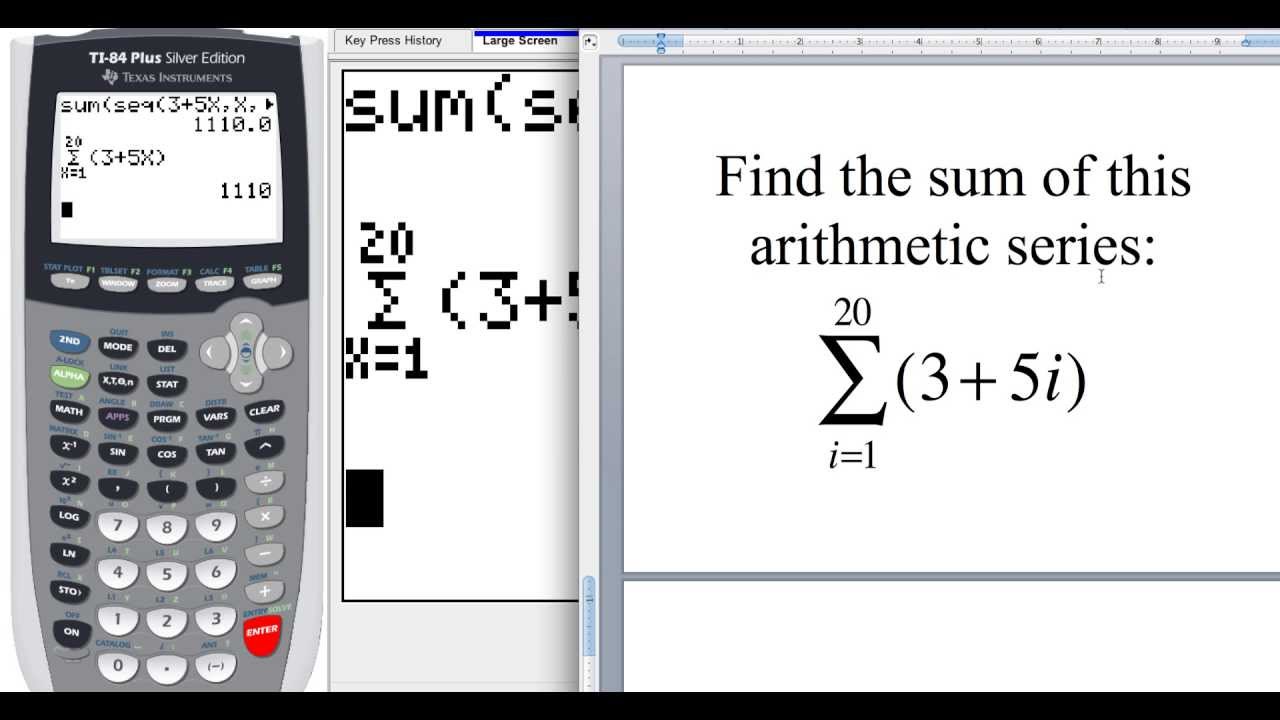

12 2 How To Find The Sum Of An Arithmetic Sequence On The Ti 84 Precalculus Graphing Calculators Arithmetic

Earnings Before Interest Tax Depreciation And Amortization Ebitda Defination Example Financial Statement Analysis Financial Statement Income Statement

Pin On Physics Maths

Pin By Pinner On Http Www Emenel Net Bookkeeping Services Cloud Accounting Document Storage

Journal Entry For Depreciation Accounting Notes Accounting Principles Journal Entries

Pin On Bussines Template Graphic Design

How To Calculate Depreciation On Fixed Assets Fixed Asset Math Pictures Economics Lessons

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

How To Calculate Book Value 13 Steps With Pictures Wikihow Economics Lessons Book Value Books

9 Arithmetic Sequence Examples Doc Pdf Excel Arithmetic Sequences Geometric Sequences Quadratics

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator

Subtraction With Negative Numbers Mr Mathematics Com Negative Numbers Subtraction Number Line

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Math Pictures Credit Education

Women Who Invest In Themselves Go Further Portiasavings Thepowerofinvestingyoung Compoundinterests Compoundintereston Investing Compound Interest Portia

Accounting And Finance Ppt Bec Doms Bagalkot Mba Finance Accounting And Finance Economics Lessons Accounting